New Delhi: The GST Council will meet in Delhi on September 3-4 to decide on the Centre's proposal for a simplified two-slab structure of 5% and 18%, along with a special 40% levy for sin goods.

The apex decision-making body for the indirect tax, comprising central and state ministers, will also consider exempting life insurance products for individuals, according to an office memorandum sent to all the states and union territories.

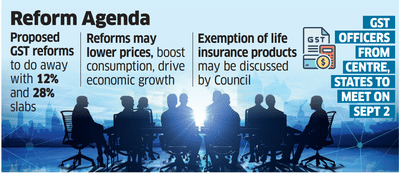

The plan for next-generation goods and services tax (GST) reforms includes scrapping the 12% and 28% slabs, ending the compensation cess, and a series of structural changes, including correction of inverted duty, aimed at boosting consumption and helping small businesses.

A meeting of GST officers from both states and Centre on September 2 will precede the council meeting.

On Friday, ET reported that the 56th GST Council may meet in the first week of next month to ensure implementation of the proposed reform in time for Diwali.

A day before, the group of ministers (GoM) on rate rationalisation unanimously accepting the Centre's proposal to move to a two-slab structure, agreeing to discussion on any revenue loss to the Centre and state on behalf of rate rationalisation or mechanism for compensating states by tax other than compensation cess on sin goods.

Once cleared by the council, the government may implement the reform and pass on the benefits in time for Diwali.

The detailed agenda for the meeting will be communicated next week. Prime Minister Narendra Modi in his Independence Day speech announced the plan to reform GST, calling it a Diwali gift.

Experts say the reforms may lower prices, boost consumption and drive economic growth amid global economic uncertainty, with immediate revenue loss to the tune of ₹45,000 crore for the current financial year.

"The proposed shift of most items from 12% slab to 5% and from 28% slab to 18% promises tangible relief for households and MSMEs while aligning with the government's broader agenda of growth and financial inclusion," said Manoj Mishra, partner and tax controversy management leader at Grant Thornton Bharat LLP.

"At the same time, careful calibration will be essential to preserve revenue neutrality and avoid inflationary pressures," he added.

The apex decision-making body for the indirect tax, comprising central and state ministers, will also consider exempting life insurance products for individuals, according to an office memorandum sent to all the states and union territories.

The plan for next-generation goods and services tax (GST) reforms includes scrapping the 12% and 28% slabs, ending the compensation cess, and a series of structural changes, including correction of inverted duty, aimed at boosting consumption and helping small businesses.

A meeting of GST officers from both states and Centre on September 2 will precede the council meeting.

On Friday, ET reported that the 56th GST Council may meet in the first week of next month to ensure implementation of the proposed reform in time for Diwali.

A day before, the group of ministers (GoM) on rate rationalisation unanimously accepting the Centre's proposal to move to a two-slab structure, agreeing to discussion on any revenue loss to the Centre and state on behalf of rate rationalisation or mechanism for compensating states by tax other than compensation cess on sin goods.

Once cleared by the council, the government may implement the reform and pass on the benefits in time for Diwali.

The detailed agenda for the meeting will be communicated next week. Prime Minister Narendra Modi in his Independence Day speech announced the plan to reform GST, calling it a Diwali gift.

Experts say the reforms may lower prices, boost consumption and drive economic growth amid global economic uncertainty, with immediate revenue loss to the tune of ₹45,000 crore for the current financial year.

"The proposed shift of most items from 12% slab to 5% and from 28% slab to 18% promises tangible relief for households and MSMEs while aligning with the government's broader agenda of growth and financial inclusion," said Manoj Mishra, partner and tax controversy management leader at Grant Thornton Bharat LLP.

"At the same time, careful calibration will be essential to preserve revenue neutrality and avoid inflationary pressures," he added.

You may also like

NYC-bound tour bus crashes: Indian, asian tourists among victims; multiple fatalities reported

Who is Tom Grennan's wife Danniella Carraturo - how they met and 'grovelling' reconciliation

Man killed his girlfriend then drove around with her body before confessing

PoK man held for allegedly sharing mosque coordinates with Indian agency

Emmerdale fans 'rumble' whose body John buried in the woods - and it's not Mack