Amid intensifying competition in the payment aggregator space, Indian fintech startups are jumping on to the agentic AI bandwagon and eyeing AI-readiness to retain merchants and online marketplaces.

Specifically, PAs such as Razorpay, Cashfree and PayU have integrated model context protocol (MCP) standards to create agent-like functionality for merchants on their payment gateways and settlement platforms.

MCP is a standard developed by Silicon Valley AI giant Anthropic to standardise how AI models interact with external tools, systems, and data sources. Leveraging MCP standards means the likes of Razorpay, Cashfree, PhonePe and others can connect LLMs to their proprietary data sources and offer seamless services for PA settlements and other use-cases such as payments orchestration.

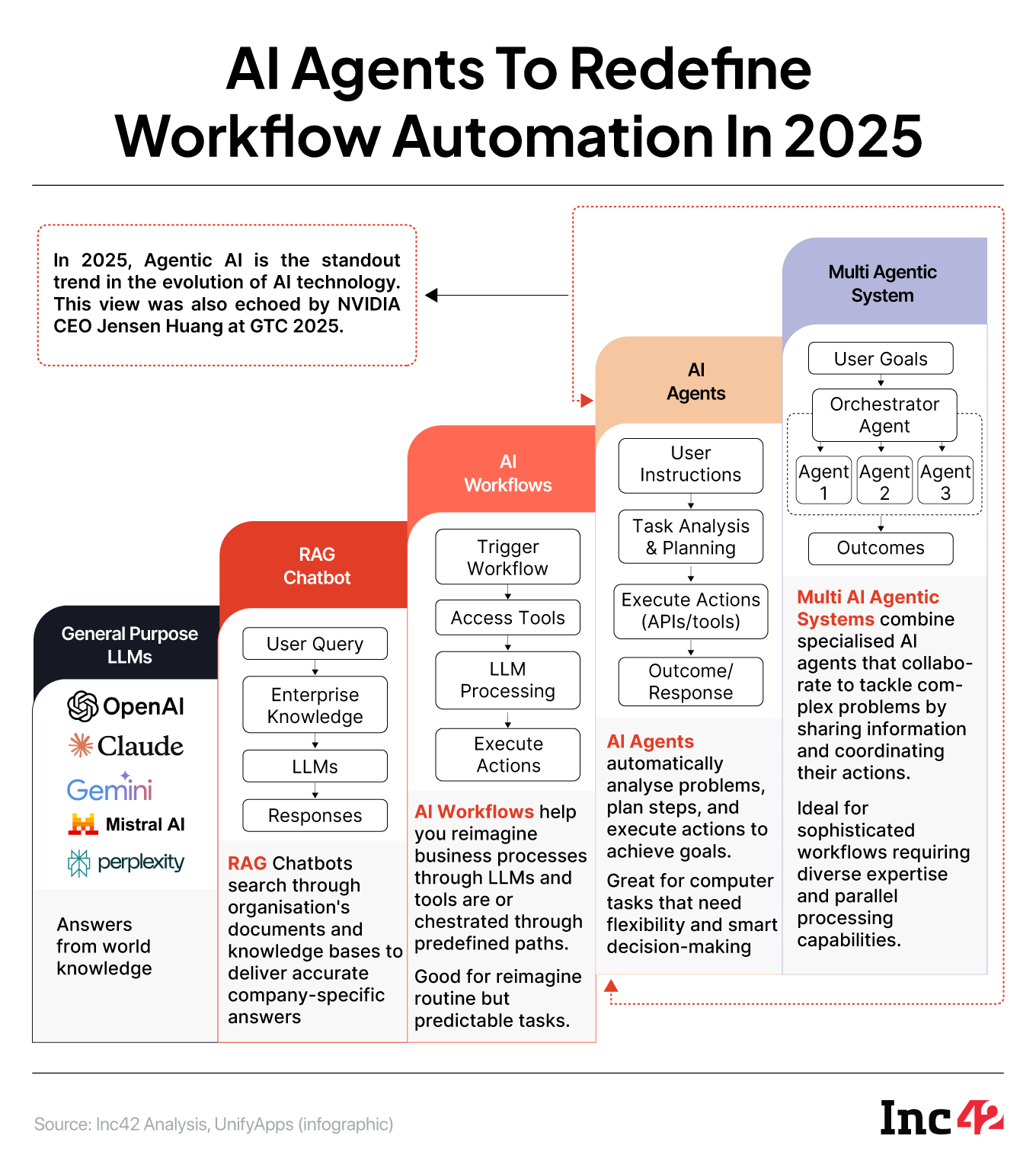

India’s AI Uprising report by Inc42 highlighted that as AI agents become increasingly sophisticated and independent, they will need to integrate with external tools and services to complete practical tasks like email communication, sales outreach, or content publishing. The model context protocol facilitates these integrations by providing a standardised way for AI systems to connect with third-party applications.

Get India's AI Uprising Report Agentic AI Comes To The ForeIn April this year, Razorpay became one of the first fintech startups in India to bring in MCP to its payment gateway platform, enabling its merchant customers to integrate Razorpay APIs to their AI assistants.

Merchants can also build AI-powered tools that can interact with Razorpay’s payment ecosystem and use the company’s APIs to perform actions. This means a brand could create a chatbot that can enable consumers to check out from online stores using Razorpay seamlessly.

Cashfree Payments and PayU also opted to follow a similar route, creating bridges between their merchants’ online platforms and the payment gateways. Will this kickstart the next phase of online payment user journeys in India?

Agentic AI is seen as the biggest step-up within generative AI use-cases in recent times. Adoption has thus far been more prominent in sectors like SaaS, logistics, financial services, healthcare among others, but payment gateways are now looking at ways to enable AI use-cases for commerce and transactions.

Logistics unicorn Shiprocket reportedly launched its MCP server in May, bringing agentic functionality to its suite — from checking shipping rates to tracking orders via simple prompts.

Similarly healthtech startup Eka Care rolled out an MCP server which it claims would improve decision-making at a clinic level, by providing verified medication information, and standardised treatment protocols from authorised and reputed medical publishers.

With agentic models now becoming a core focus for LLM makers, others will also follow.

Payment Gateways Get MCP BoostIn the case of the fintech industry, agentic models have thus far been seen as a replacement for the feet-on-the-ground or human customer support systems. The use case was restricted to job profiles that literally fit the agent billing. While the likes of Paytm claimed to be working on integrating AI in its core payment business, as revealed by chief executive Vijay Shekhar Sharma, these were limited experiments, AI wrappers or chatbots.

There’s also a lot of algorithmic and machine learning heavy work being done in the backend for transaction success, and fraud detection and prevention. But thus far Indian fintech players — particularly payment gateways — had not opened up their platforms for agentic models.

Before MCP, payment aggregators faced the challenge of fragmentation in AI integration, as each LLM — whether it is ChatGPT, Gemini or Llama — required customised application programming interface (APIs). These models were also hamstrung by limited access to real-time internal data and lacked the right context.

Having experimented with MCP servers, PayU feels it can be useful for actions such as initiating refunds, creating and sending payment links and reconciliation.

Describing the integration of the model, PayU chief technology officer Narendra Babu told Inc42, “MCP server integrations eliminate hours that merchants previously spent filling forms for financial processes. Within minutes now, PayU merchants across all sizes can now automate their financial tasks such as generating payment links, fetching payment statuses, and checking transaction details in seconds. This technology is a step forward in fintech, which enables businesses to make their financial operations simpler and more efficient.”

PayU says its MCP server provides specialised integration that enables AI software and chatbots to securely access PayU platform APIs and complete actions. “This integration allows AI assistants to create payment links, retrieve transaction details, and access invoice information directly, making your payment workflows smarter and more efficient.”

Can Agentic AI Help Beat The Competition?The payments aggregator market has become an intense battlefield with more than two dozen payments aggregators joining the mix since 2024. Even UPI leaders like PhonePe have jumped into the battle and have armed themselves with a PA licence. What used to be an open market has become one where many are growing insular.

In January, for instance, PhonePe, Razorpay and Cashfree Payments paused integrations with third-party payment orchestration platforms and said they would instead only rely on their in-house solutions.

In this regard, MCP and agentic AI models can allow payment gateways to double down on their own customer base and retain users. Agentic models allow merchants to offer hyper-personalised services to their customers.

Mayank Juneja, architect at Cashfree Payments, explained: “Cashfree’s MCP server is built around context-aware automation. It continuously listens for customer intent. For example, ‘I want to order a cake’ or ‘I need to do KYC of my vendor’. And then it intelligently maps that to the right workflow. By identifying the context (i.e ordering or KYC), the AI intelligently triggers the appropriate API calls, generates links, and completes the process autonomously, without human intervention.”

Like other agentic tools, Cashfree’s MCP-led features can be accessed by merchants on WhatsApp or other channels that they frequently use. This specifically targets Indian SMBs since they would want such features without investing in technology.

How Merchants Can Streamline PaymentsRazorpay said in a statement that merchant payments were previously initiated and authorised by businesses using the Razorpay dashboard. But now this can be done through their AI assistants directly.

For the first time, AI agents and tools like Claude, Zapier, VS Code can now natively talk to Razorpay, the company added, to create payment links, fetch orders, manage payments.

Elaborating on this industry insiders said, this is what merchants can expect with MCP integration:

- Structured Payment Link Management: Generate, create, send, and update payment links to the customer in a matter of seconds

- Refund and Transaction Process: MCP servers also help merchants in handling refunds, settlements, and payouts via natural language prompts in real time

- Streamline Workflow Automation: When merchants integrate their AI bots with the MCP servers, it allows them to benefit from automating everyday repetitive tasks, like payment reminders or confirmations

- Enhance Customer Experience: Allows merchants to be more responsive to customers’ payment experience

Of course, one cannot look at AI-first operations and not address the elephant of regulations, particularly in the fintech market. At the moment, payment gateways and aggregators are relying on existing data protection mechanisms and laws when deploying agents or MCP servers.

But the regulatory eye will fall on AI soon and its use-cases in sensitive industries.

Last year, the Reserve Bank of India (RBI) set up a committee to develop a framework for responsible and ethical enablement of artificial intelligence (FREE-AI) in the financial sector.

Additionally, the central bank will also work on identifying and providing solutions for any potential risk associated with AI in the finance sector, and creating a framework for ethical adoption of AI models in this sector.

Meanwhile, it is pertinent to note that numerous other fintech players have obtained approvals for a PA licence in the past two years. The likes of Getepay, Easebuzz, MobiKwik, CRED, Groww, Pine Labs, CCAvenue, mSwipe, Google Pay among others have received the regulatory nod to launch PA operations.

As we explained in this piece last May, the primary attraction for a payment aggregator licence is that entities can enable ecommerce sellers and other merchants in India to accept various payment instruments from customers, pool these collections and get settlements through PAs, without the need to create a separate payment integration system of their own.

Essentially, PAs act as intermediaries between the merchant and the customer, ensuring that funds are transferred in a timely manner to the former.

This is the evolution of the payment gateway model that catalysed Indian ecommerce, and the more mature payment aggregator ecosystem now is waiting for a shot in the arm. Will MCP and agentic AI be this next inflection point?

The post Smart Pay: Razorpay, Cashfree & Co Are Jumping On The Agentic AI Bandwagon appeared first on Inc42 Media.

You may also like

'Ease of Living' boost: Piped gas to reach every home in Bihar's Motihari

Nazara's Sportskeeda To Buy US Entertainment Portal 'Prime Timer'

Ego writes the Headline, Truth gets only a byline

'Mask is off': Rahul Gandhi accuses RSS-BJP of undermining Constitutional spirit

Cole Palmer's biggest Chelsea pal backs 'little superstar' to handle new spotlight