Once a unicorn and looking to build India’s content-to-commerce space, the Good Glamm Group (GGG) is now staring at a bleak horizon.

The startup has shut down its offices across India, employees have been unpaid for months and lenders have stepped in to steer the company. So, what’s wrong with GGG?

A String Of Bad Decisions? The seeds of GGG’s current crisis seem to have been sown during its aggressive acquisition spree in 2021 and 2022, when it snapped up more than 10 beauty and content brands. What followed were strategic missteps to centralise operations, marketing, and product development, which led to widespread confusion, quality control issues, and team dissatisfaction.

Adding to the capital burn, the company poured resources into offline retail and international expansion, even as its online traffic failed to convert into meaningful sales.

Crisis Unfolds: Amid the ongoing fracas, revenues have tanked and debt payments are looming heavily over the struggling company. Consequently, the company is undergoing a restructuring exercise and lenders have taken over GGG’s ship.

Founder and CEO Darpan Sanghvi’s role has been limited to raising funds – a quest that has so far yielded no success.

End Of A Unicorn: With investors wary of pumping any additional capital, the content-to-commerce startup has resorted to approaching founders of its acquired portfolio companies to offload assets and generate cash for its lenders. However, even selling these brands for pennies on the dollar is proving challenging due to substantial liabilities and a significant exodus of experienced leadership.

Caught in the crossfire are the company’s employees, who haven’t received salaries for two months. Lenders, too, are waiting to get their dues cleared. With funding drying up and investors likely writing off their stakes, Good Glamm Group’s survival is now in question. For now, here’s how its house of cards came crashing down.

From The Editor’s DeskStartup Funding Last Week: Indian startups cumulatively raised $314.6 Mn across 21 deals last week, up 13% from $278.3 Mn raised across 22 deals in the preceding week. Jumbotail and Infra.Market topped the charts by raising $120 Mn and $50 Mn, respectively.

New-Age Tech Stocks Tank: Twenty-one of the 34 new-age tech stocks under Inc42’s purview fell in the range of a marginal 0.01% to close to 7%. FirstCry and Go Digit were the biggest losers while TBO Tek and DroneAcharya were the biggest gainers.

Smartwork’s FY25 Report Card: The coworking major’s net loss widened 26.5% YoY to INR 63.2 Cr in FY25. Operating revenue zoomed 32% YoY to INR 1,374.1 Cr. Smartworks filed its RHP for the upcoming IPO, which will open on July 10 and close on July 14.

Khetika Bags $18 Mn: The farm-to-fork startup has raised the funds in a Series B round led by the Narotam Sekhsaria Family Office and Anicut Capital. It sells preservative-free, minimally processed foods like batters, chutneys, spices, millets, makhana, rice and dry fruits.

Peyush Bansal Eyes More Lenskart Shares: The startup’s cofounder and CEO is looking to buy back up to a 2% stake in the eyewear retailer from existing investors for $150 Mn at a $7 Bn to $8 Bn valuation. Lenskart will file its DRHP in the next 4-6 weeks.

InMobi Nets INR 32 Cr: The adtech unicorn’s cofounders and Vatera Pte. Ltd have infused the fresh capital into the IPO-bound startup to address working capital needs. InMobi is looking to reverse flip to India and is eyeing a $1 Bn public listing.

K’taka’s Gavel On Fake News: The state government’s draft bill to curb misinformation proposes a jail term of up to seven years, hefty fines and the creation of a regulator to police digital content. But, critics are raising concerns of unfair censorship, political bias, and overreach.

How Startups Fared In FY25? Out of the 31 new-age tech startups that have released their FY25 numbers, nine reported a cumulative net loss of INR 7,410 Cr while 22 reported a cumulative net profit of INR 3,312.4 Cr. Total revenue grew 23% YoY to INR 1.05 Lakh Cr.

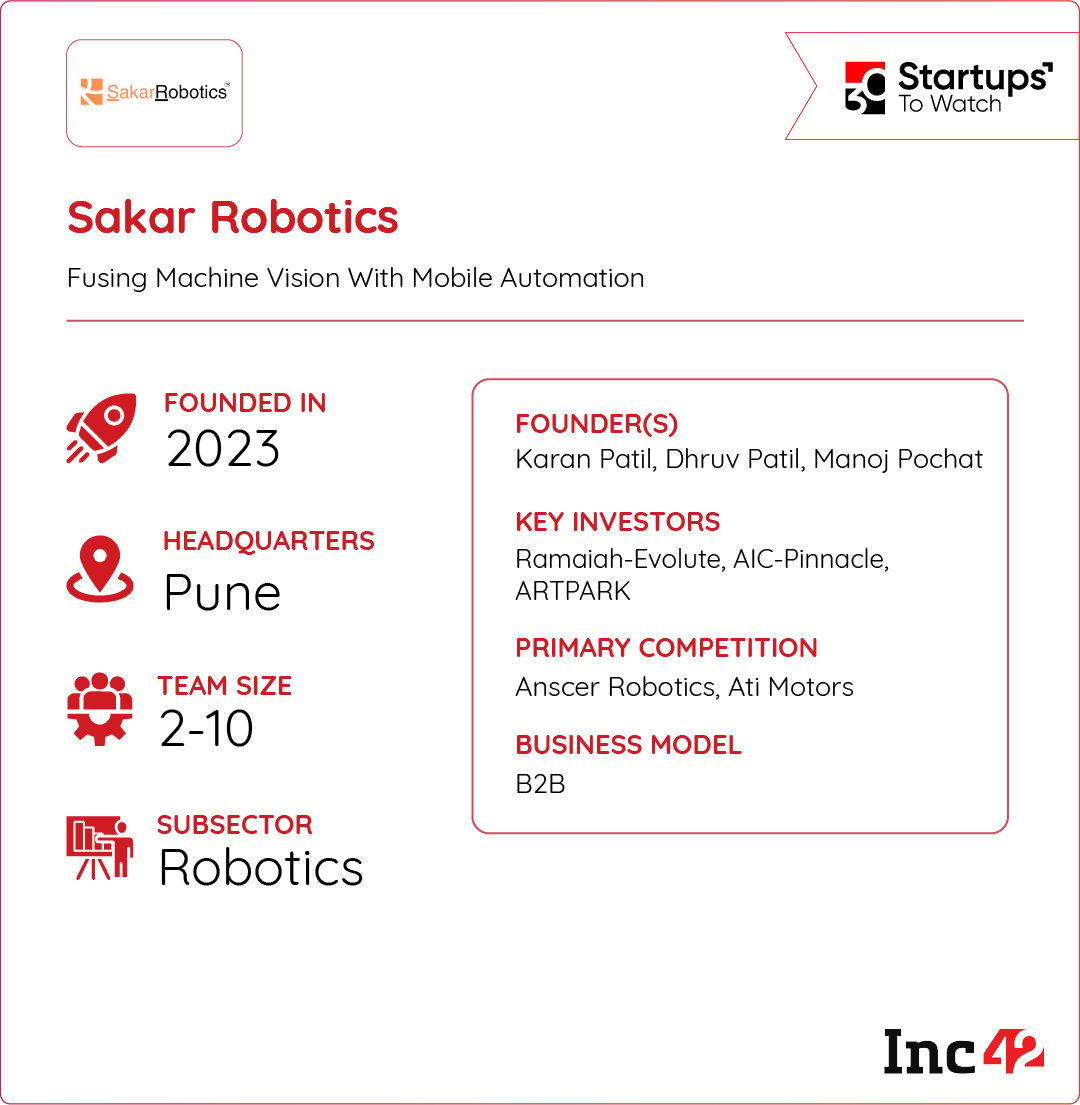

Inc42 Startup Spotlight Can Sakar’s Mobile Robots Disrupt Industrial Operations?As India moves towards Industry 4.0, autonomous robots are emerging as a preferred pillar to make precision manufacturing more efficient and reduce errors. Pioneering this adoption in the country is Pune-based deeptech startup Sakar Robotics.

Founded in 2023 by IIT Roorkee alumni Karan Patil, Dhruv Patil and Manoj Pochat, the startup is developing autonomous and mobile robots that can automate linen inspection, indoor payload mobility and inspection.

Sakar’s Robot Science: The startup has developed mobile robots and advanced machine vision systems, built at the intersection of hardware and software, which can make autonomous decisions and take actions. By focussing on “single machine, multiple tasks” and integrating cognitive capabilities, Sakar’s robots are designed to navigate unpredictable environments and handle various functions across industries.

The startup caters to various sectors such as manufacturing, logistics, and healthcare with the help of its robots.

Rising Competition: It competes with the likes of Ancer Robotics and ATI Motors, which are also in the race to capitalise on India’s industrial automation market, expected to reach $8.26 Bn by 2030.

With a vision to make high-impact automation more accessible and cost-effective, can Sakar Robotics disrupt the Indian industrial automation space?

The post The Fall Of Good Glamm, Startup Funding Last Week & More appeared first on Inc42 Media.

You may also like

Grange Hill's Zammo star shares health update as he opens up on cancer scare

Gopal Khemka case a priority, Bihar Police, STF working on leads: DGP Vinay Kumar

Andhra Pradesh gears up for mega PTM with record participation on July 10

Poundland set to close store within weeks as customers not happy - 'very sad'

Nora Fatehi crying at airport goes viral. Is the actress-dancer mourning a personal loss?